Choosing the right insurance policy can be challenging, but it’s essential for financial security. From health and life to auto and home insurance, this guide will help you understand what to consider.

Overview: Start by determining what type of coverage you need based on your life situation, such as health, auto, or life insurance.

Key Tips:

List Priorities: Consider factors like family size, health status, and asset protection needs.

Consider Risks: Different policies cover various risks; prioritize according to your lifestyle.

Overview: Familiarize yourself with various insurance options like term, whole, and universal life for life insurance, or HMO vs. PPO for health insurance.

Key Tips:

Compare Plans: Each policy has pros and cons; research to find what fits best.

Check Benefits: Look into premium costs, coverage limits, and policy flexibility.

Overview: The cost of a policy should be weighed against the coverage provided to ensure it meets your budget and needs.

Key Tips:

Premiums vs. Benefits: Lower premiums might mean higher deductibles or fewer benefits.

Budget Allocation: Choose a policy you can afford to maintain long-term.

Overview: A reputable insurer is essential for reliable service and smooth claims processing.

Key Tips:

Customer Reviews: Check reviews and ratings from current policyholders.

Financial Strength: Confirm the insurer’s financial stability through third-party ratings.

Overview: Understanding the terms and conditions will help you avoid surprises during claim time.

Key Tips:

Know Exclusions: Be aware of what is not covered by the policy.

Understand Renewal Terms: Some policies have changes upon renewal; review each term.

Choosing the right insurance policy is a personalized process that requires time and consideration. By evaluating your needs, researching options, and selecting a trustworthy provider, you can secure the coverage that best protects you and your loved ones.

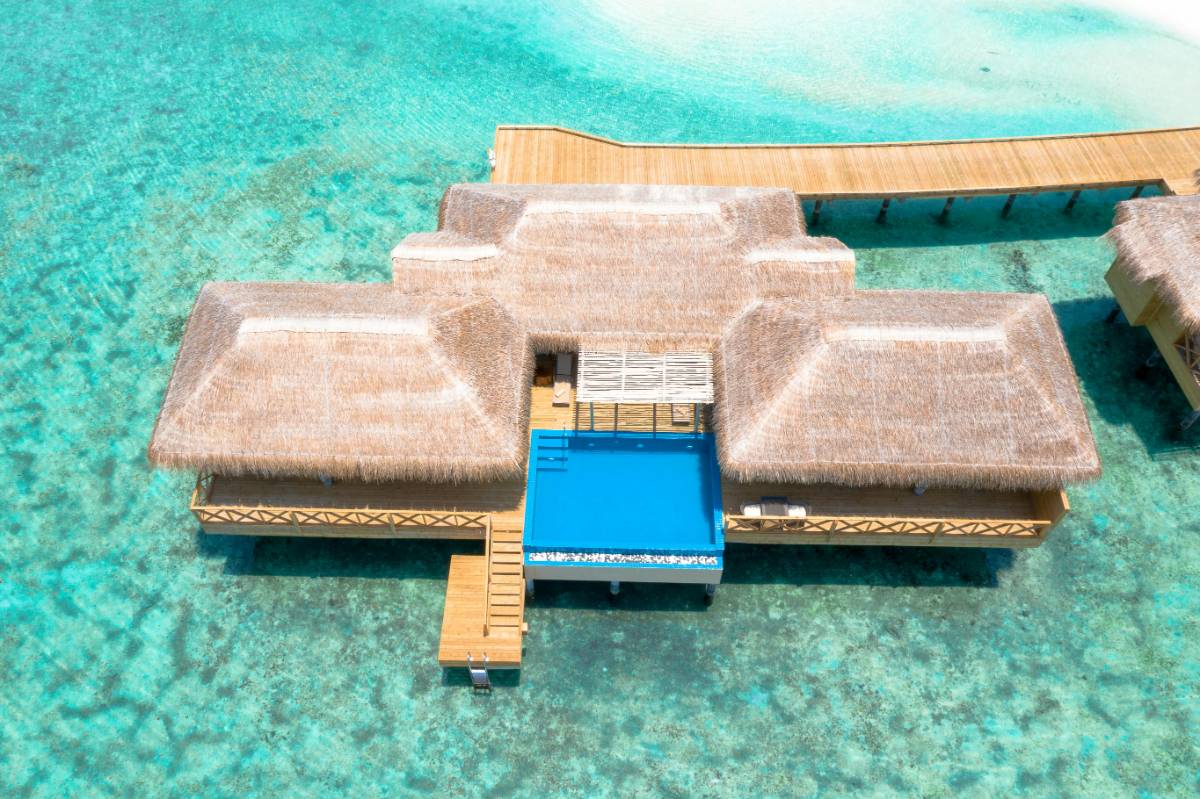

There’s something magical about a beach destination that invites relaxation, with its calming waves, warm sands, and the gentle rustling of palm trees. From secluded shores to luxurious resorts, here’s a guide to some of the most unforgettable beach destinations that guarantee the ultimate relaxation experience.

Investing in real estate can be highly rewarding, but choosing the right property is crucial. A good investment goes beyond just location; it involves analyzing various factors like market trends, rental potential, and long-term appreciation. Here’s how you can spot a good real estate investment before making a purchase.

Step into the Soul of the South: Dance through New Orleans, Rock with Elvis, and Relive Music History!

Managing your finances wisely is crucial at every stage of life. Each decade comes with unique financial challenges, and making the wrong moves can impact your future. In this article, we’ll explore common financial mistakes to avoid in your 20s, 30s, and 40s to set yourself up for financial success.

In recent years, there has been a growing shift towards mixed-use real estate developments, combining residential, commercial, and recreational spaces into one cohesive environment. These developments offer a dynamic alternative to traditional single-use properties and are gaining popularity for their convenience, sustainability, and ability to create vibrant communities. In this article, we explore the reasons behind the rise of mixed-use developments and the benefits they offer.

Here are some tips to help you refine your social media strategy as a real estate professional: